Hicksian demand function

In microeconomics, a consumer's Hicksian demand correspondence is the demand of a consumer over a bundle of goods that minimizes their expenditure while delivering a fixed level of utility. If the correspondence is actually a function, it is referred to as the Hicksian demand function, or compensated demand function. The function is named after John Hicks.

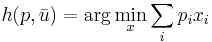

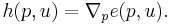

Mathematically,

where h(p,u) is the Hicksian demand function, or commodity bundle demanded, at price level p and utility level  . Here p is a vector of prices, and X is a vector of quantities demanded so that the sum of all pixi, is the total expense on goods X.

. Here p is a vector of prices, and X is a vector of quantities demanded so that the sum of all pixi, is the total expense on goods X.

Contents |

Relationship to other functions

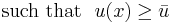

Hicksian demand functions are often convenient for mathematical manipulation because they do not require income or wealth to be represented. Additionally, the function to be minimized is linear in the  , which gives a simpler optimization problem. However, Marshallian demand functions of the form

, which gives a simpler optimization problem. However, Marshallian demand functions of the form  that describe demand given prices p and income

that describe demand given prices p and income  are easier to observe directly. The two are trivially related by

are easier to observe directly. The two are trivially related by

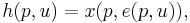

where  is the expenditure function (the function that gives the minimum wealth required to get to a given utility level), and by

is the expenditure function (the function that gives the minimum wealth required to get to a given utility level), and by

where  is the indirect utility function (which gives the utility level of having a given wealth under a fixed price regime). Their derivatives are more fundamentally related by the Slutsky equation.

is the indirect utility function (which gives the utility level of having a given wealth under a fixed price regime). Their derivatives are more fundamentally related by the Slutsky equation.

Whereas Marshallian demand comes from the Utility Maximization Problem, Hicksian Demand comes from the Expenditure Minimization Problem. The two problems are mathematical duals, and hence the Duality Theorem provides a method of proving the relationships described above.

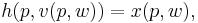

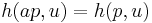

The Hicksian demand function is intimately related to the expenditure function. If the consumer's utility function  is locally nonsatiated and strictly convex, then

is locally nonsatiated and strictly convex, then

Hicksian Demand and Compensated Price Changes

Downward sloping Marshallian demand curves show the effect of price changes on quantity demanded. As the price of a good rises, presumably the quantity of that good demanded will fall, holding wealth and other prices constant. However, this price changes due to both the income effect and the substitution effect. The substitution effect is a price change that alters the slope of the budget constraint but leaves the consumer on the same indifference curve (i.e., at the same level of utility.) By this effect, the consumer is posited to substitute toward the good that becomes comparatively less expensive. If the good in question is a normal good, then the income effect from the rise in purchasing power from a price fall reinforces the substitution effect. If the good is an inferior good, then the income effect will offset in some degree the substitution effect.

The Hicksian demand function is also downward sloping, but isolated the substitution effect by supposing the consumer is compensated exactly enough to purchase some bundle on the same indifference curve. Hicksian demand illustrates the consumer's new consumption basket after the price change while being compensated as to allow the consumer to be as happy as previously (to stay at the same level of utility). If the Hicksian demand function is "steeper" than Walrasian demand, the good is a normal good; otherwise, the good is inferior.

Mathematical Properties

If the consumer's utility function  is continuous and represents a locally nonsatiated preference relation, then the Hicksian demand correspondence

is continuous and represents a locally nonsatiated preference relation, then the Hicksian demand correspondence  satisfies the following properties:

satisfies the following properties:

i. Homogeneity of degree zero in p: For all  ,

,  . This is because the same x that minimizes

. This is because the same x that minimizes  also minimizes

also minimizes  subject to the same constraint.

subject to the same constraint.

ii. No excess demand: The constraint  holds with strict equality,

holds with strict equality,  . This follows from continuity of the utility function. Informally, they could simply spend less until utility was exactly

. This follows from continuity of the utility function. Informally, they could simply spend less until utility was exactly  .

.

See also

References

- Mas-Colell, Andreu; Whinston, Michael & Green, Jerry (1995). Microeconomic Theory. Oxford: Oxford University Press. ISBN 0-19-507340-2.